MAKE BETTER BUSINESS DECISIONS

Making prudent and timely business decisions starts with accurate and up-to-date bookkeeping. As a business owner, it’s essential to read and understand your financial statements on a periodic basis throughout the year. Not only will this help you determine what is working and what is not working, it will provide the foundation for solid and effective tax planning. We recommend hiring a firm to handle the bookkeeping to ensure that is get’s done right. When comparing the value achieved with quality financial statements to the cost, it’s a very good investment.

Making prudent and timely business decisions starts with accurate and up-to-date bookkeeping. As a business owner, it’s essential to read and understand your financial statements on a periodic basis throughout the year. Not only will this help you determine what is working and what is not working, it will provide the foundation for solid and effective tax planning. We recommend hiring a firm to handle the bookkeeping to ensure that is get’s done right. When comparing the value achieved with quality financial statements to the cost, it’s a very good investment.

DON’T MISS THIS MAINE TAX CREDIT

If you received an undergraduate degree from an accredited Maine college or university after 2007 and subsequently live, work, and pay taxes in Maine you are VERY LIKELY eligible for the Education Opportunity Tax Credit. This credit can be thousands of dollars and many young people are missing out on this simply because they do not know about it. If you've filed a return and think you missed out on this, call us, we can help!

If you received an undergraduate degree from an accredited Maine college or university after 2007 and subsequently live, work, and pay taxes in Maine you are VERY LIKELY eligible for the Education Opportunity Tax Credit. This credit can be thousands of dollars and many young people are missing out on this simply because they do not know about it. If you've filed a return and think you missed out on this, call us, we can help!

ATTENTION DENTISTS!

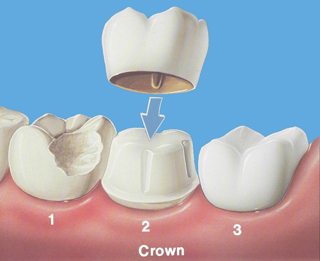

A little known fact is that dental offices can qualify for the domestic production activity deduction if they are producing crowns using equipment such as a CEREC or other CAD/CAM technology. If you’re a dentist and you’re not sure if you qualify for this deduction, contact us. We can evaluate your processes to determine if you already qualify, or offer recommendations on what could do in order to qualify.

A little known fact is that dental offices can qualify for the domestic production activity deduction if they are producing crowns using equipment such as a CEREC or other CAD/CAM technology. If you’re a dentist and you’re not sure if you qualify for this deduction, contact us. We can evaluate your processes to determine if you already qualify, or offer recommendations on what could do in order to qualify.